- Wings9 Consultancies

- Published: January 29, 2026

Can You Get UAE Residency Without Living in Dubai? (2026 Rules)

Dubai remains one of the world’s most entrepreneur-friendly hubs in 2026. Company formation continues to rise across mainland and free zones—especially among NRIs, remote founders, consultants, and global investors looking for stability and tax efficiency.

But there’s a question we hear every single week at Wings9:

Can I get UAE residency without living in Dubai?

The short answer: Yes, in some cases.

The smart answer: It depends on what you mean by “residency.”

Because in 2026, the UAE is very clear about one thing:

Holding a UAE residence visa is not the same as being a UAE tax resident.

This guide breaks down the 2026 rules, real compliance expectations, and what you can legally do—so you can build a residency strategy that’s sustainable, bank-friendly, and future-proof.

Quick Answer

UAE residency without living in Dubai is possible in 2026 if you hold a valid UAE residence visa (via company, employment, freelancer, or Golden Visa) and follow the entry rules. However, most UAE residence visas become invalid if you stay outside the UAE for more than 6 months continuously, unless exemptions apply.

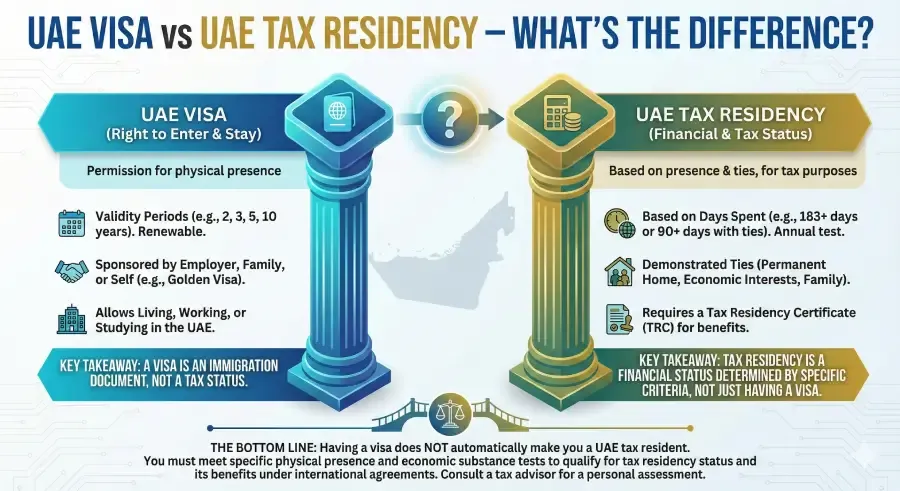

UAE Residency in 2026: Visa Residency vs Tax Residency (Big Difference)

This is where most online content gets misleading.

✅ UAE Visa Residency

This means you have a UAE residence visa and an Emirates ID.

You can:

open personal bank accounts (subject to bank policy)

sponsor family (depending on visa type)

access UAE services

✅ UAE Tax Residency

This is an entirely separate status. It relates to:

physical presence days

centre of life/business ties

TRC eligibility (Tax Residency Certificate)

In tax planning, UAE residency without living in Dubai often really means tax residency without living full-time. That’s where the legal complexity begins.

2026 Rule You Must Know: The “6-Month Outside UAE” Limit

For regular UAE residence visas:

If a UAE residence visa holder stays outside the UAE for more than six months continuously, the residence visa is nullified automatically.

This single rule is the biggest reality check for anyone pursuing UAE residency without living in Dubai.

So, can you stay abroad and still keep the visa?

Yes—but only if:

you return within 6 months, or

you qualify for exemptions, or

you obtain a valid permit/approval for extended stay

Exceptions: Who Can Stay Outside the UAE Longer?

1) Golden Visa Holders (Most Flexible)

Golden Visa holders can stay outside the UAE beyond the usual six-month limit while keeping residency valid.

That makes the Golden Visa one of the strongest options for:

global investors

HNIs

senior professionals

high-value business owners

If your goal is Dubai residency without a residence requirement, the Golden Visa is often the cleanest legal path.

2) Permit for Residents Staying Outside the UAE (ICP)

For certain cases, a resident may apply for an official permit to remain outside the UAE for more than six months, with valid reasons and supporting documents.

This is practical for:

overseas work assignments

study

medical situations

Wings9 Insider Tip: Many people assume this is automatic. It’s not. Documentation and timing matter. Done incorrectly, the permit route fails, and you risk visa cancellation.

3) Remote Work / Virtual Work Programs

Dubai offers a remote working visa route designed for people working outside the UAE while residing in Dubai.

GDRFA’s virtual work visa requirements include:

proof of remote employment

monthly income (commonly USD 3,500+)

health insurance

Important: This visa is built for people who want to live in Dubai while working remotely, not for those who want to never enter the UAE.

Can You Keep UAE Residency Without Staying in the UAE? (Reality vs Marketing)

Let’s answer this directly.

✅ Yes, you can keep UAE residency with limited time in the UAE—IF:

You return within the 6-month window (most visas)

Or you hold a Golden Visa

Or you get an approved outside-UAE permit

❌ No, you cannot “hold UAE residency forever without entering the UAE”

If you don’t maintain entry compliance, your visa may become inactive or cancelled.

In other words, UAE residency without living in Dubai doesn’t mean “never visit the UAE.” It means not living full-time, while meeting legal conditions.

Best Residency Routes for People Who Don’t Want to Live Full-Time in Dubai

At Wings9, we map residency strategy to lifestyle and legal reality. Here are the most relevant options:

Option A: Investor/Partner Visa via Company Formation

If you open a company (mainland or free zone), you can obtain investor/partner residence.

Best for:

entrepreneurs

business owners

NRIs with GCC expansion plan

Limitations:

6-month absence rule applies (in most cases)

Option B: Golden Visa (Highly Recommended for Global Mobility)

Best for:

HNIs

professionals meeting criteria

investors with a long-term strategy

Why it’s strong:

more flexible absence rules

long-term stability (5 or 10 years)

If you’re serious about UAE residency without living in Dubai, the Golden Visa is a premium route worth considering.

Option C: Virtual Work Visa (Remote Working Program)

Best for:

digital nomads

remote professionals

founders running global operations

But:

It’s designed for living in the UAE while working remotely

Option D: Freelancer / Green Residency (Case-Dependent)

Freelancer / Green Residency options remain active, though authorities have tightened review procedures to prevent misuse.

This is relevant for:

consultants

creatives

independent professionals

Tax Residency 2026: The Real Goal for Many NRIs & Expats

Here’s the uncomfortable truth:

Many people searching for UAE residency without living in Dubai really want:

✅ a UAE Tax Residency Certificate (TRC)

✅ to support tax positioning in their home country

But the TRC depends on physical presence rules.

How Many Days Must You Stay in the UAE for Tax Residency?

The UAE has defined criteria relating to physical presence and ties.

TRC Common Benchmarks (General Understanding)

183 days or more (strongest route)

or 90+ days with additional conditions (residence + business ties)

FTA’s TRC service requirements mention scenarios including physical presence of 183 days or more, and cases for 90–182 days depending on conditions.

Professional firms (like EY/KPMG) also interpret and explain the 90-day condition in line with UAE tax residency criteria.

✅ Conclusion: You can’t reliably claim UAE tax residency with “zero days in UAE.”

Important: Residency Visa ≠ Tax Residency (Common Mistake)

Many founders assume:

“I have a Dubai visa, so I’m a UAE tax resident.”

Not necessarily.

Tax residency requires:

proof of physical presence

proof of accommodation/residence

business/employment ties in many cases

If your objective is tax planning, Wings9 always advises doing this properly—because weak structures get challenged first by banks, then by tax authorities abroad.

Best Strategy for Entrepreneurs: Set Up Correctly (Mainland vs Free Zone)

If you plan to use a business setup as your residency path, choosing the correct structure matters.

We recommend reviewing our pillar guide first:

👉 https://wings9.ae/company-formation-in-dubai-2026-mainland-vs-free-zone/

Why it matters:

Visa quotas differ

Office requirements differ

Compliance expectations differ

“substance” varies in credibility

UAE Residency Without Living in Dubai: What You Can Do vs Can’t Do (2026 Table)

Goal | Possible Without Living Full-Time? | What’s Required |

|---|---|---|

Hold a UAE residence visa | ✅ Yes | Maintain entry rules (6-month rule or exception) |

Stay outside the UAE for> 6 months | ✅ Sometimes | Golden Visa or approved permit |

Get an Emirates ID | ✅ Yes | Entry + biometrics required |

Open a UAE bank account | ✅ Possible | Strong KYC + clear profile |

Get UAE TRC | ⚠️ Limited | Physical presence criteria |

“Never visit the UAE” strategy | ❌ Not reliable | A visa becomes invalid over time |

Wings9 Practical Insider Tips (Boots-on-the-Ground)

✅ Tip 1: Entry planning matters more than visa issuance

We plan your entry schedule before stamping the visa so you don’t get caught by the 6-month clock.

✅ Tip 2: Banking success depends on “story clarity”

Banks don’t just check documents—they check logic. Revenue source, activity, and residency pattern must make sense.

✅ Tip 3: Don’t chase “cheap visa packages”

Cheap shortcuts often cause:

visa cancellation risk

rejected bank accounts

non-usable TRC goals

FAQ

1) Can I get UAE residency without living in Dubai?

Yes. You can hold a UAE residence visa without living full-time in Dubai, but most visas require you to enter the UAE at least once every six months to remain valid.

2) Can I keep UAE residency if I stay outside the UAE for more than 6 months?

In most cases, your visa may be cancelled. Exceptions include Golden Visa holders and individuals approved for an outside-UAE permit.

3) Does the Golden Visa allow staying outside the UAE longer?

Yes. Golden Visa holders can stay outside the UAE beyond the usual six-month limit and still keep their residency valid.

4) Can I get UAE tax residency without staying in the UAE?

Not reliably. UAE tax residency/TRC requires physical presence criteria (commonly 183 days, or 90+ days with conditions).

5) What visa is best for digital nomads in Dubai?

Dubai’s Virtual Work Visa is designed for remote employees and entrepreneurs who want to live in Dubai while working for a foreign employer.

6) Can Wings9 help with UAE residency planning?

Yes. Wings9 supports end-to-end residency strategies, including company setup, visa processing, Emirates ID, banking readiness, and long-term residency planning.

7) Will UAE residency help with tax planning for NRIs?

It can—but only with proper planning, physical presence strategy, and compliance evidence. We recommend a structured advisory to avoid future challenges.

Pillar Page Integration

If you’re planning residency via business setup (mainland vs free zone), start here first:

👉 https://wings9.ae/company-formation-in-dubai-2026-mainland-vs-free-zone/

Your structure impacts:

visa type and quotas

compliance profile

banking acceptability

long-term expansion options

Wings9 2026 Outlook (Unique Takeaway)

Here’s our forward-looking view for 2026:

UAE residency is shifting from “visa ownership” to “compliance-backed residency.”

Authorities and banks are now aligned on credibility:

entry records

Emirates ID activity

real business ties

financial substance

We believe 2026 will reward founders and investors who build clean, defensible residency strategies—instead of chasing “paper residency.”

If your goal is UAE residency without living in Dubai, the smartest route is a hybrid approach:

✅ legal visa type

✅ entry discipline

✅ banking-ready structure

✅ tax residency planning based on reality

That’s exactly what we build at Wings9.

Ready to build a clean UAE residency plan?

We at Wings9 Management Consultants support company formation, visa processing, Emirates ID, and residency strategy planning—end-to-end.

Start your Dubai journey with Wings9.