Dubai Freelance Permit vs LLC 2026: Cost & Legal Guide

Dubai in 2026 is no longer just a city for big corporates—it’s become a serious launchpad for freelancers, consultants, coaches, creators, and solopreneurs who want global clients while living in a tax-efficient, premium ecosystem.

But when you’re ready to work legally, there’s one decision that decides everything from your cost to your credibility:

Dubai Freelance Permit vs LLC — which option is smarter in 2026?

At Wings9, we help first-time business owners and expat entrepreneurs choose the right structure based on the real-world factors that matter: visas, bank accounts, contracts, taxes, scalability, and long-term compliance. This isn’t a brochure comparison. This is the truth, based on what we see on-ground daily.

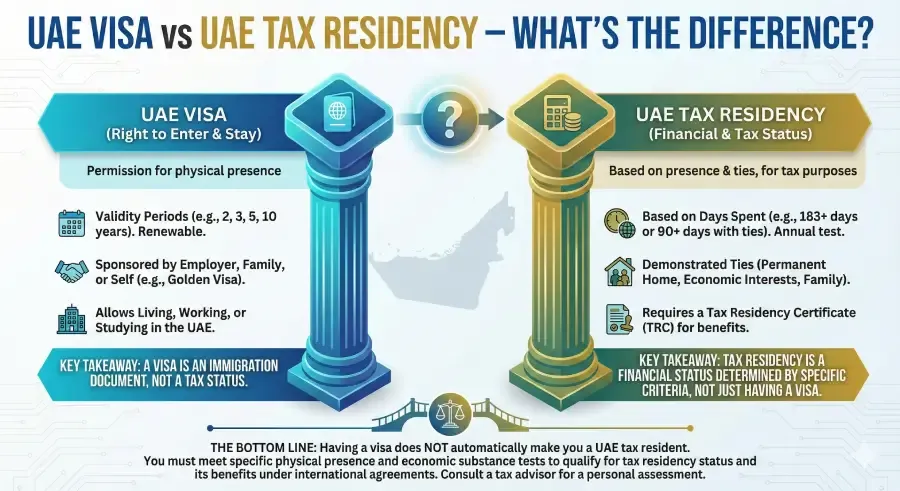

Quick Answer

Dubai Freelance Permit vs LLC comes down to business scope. A freelance permit is cheaper and ideal for solo professionals offering services under their personal name. An LLC is better if you want maximum credibility, hire staff, sign larger UAE contracts, expand activities, and scale long-term with stronger legal protection.

Why This Comparison Matters More in 2026

The freelance economy is booming in the UAE, but regulators and banks have also tightened standards.

In 2026:

Banks prefer structured documentation

UAE corporate tax compliance expectations are clearer

Businesses demand proper invoices/contracts

Visa planning has become strategic (not an afterthought)

So choosing wrong can cost you months—not just money.

This is why people searching for Dubai Freelance Permit vs LLC are already in the decision stage—and they need clarity, not confusion.

Understanding the 2 Options

What Is a Dubai Freelance Permit?

A freelance permit is a legal authorisation allowing an individual to work independently in a specific profession (like marketing, design, IT, media, consulting) under a Free Zone authority.

It’s built for:

solo professionals

remote workers with clients globally

low-cost legal operation

Freelance permits are typically issued via Free Zones and align with the UAE licensing frameworks under the relevant authorities.

What Is an LLC in Dubai?

An LLC (Limited Liability Company) is a full company structure registered either in:

Dubai mainland (DET), or

Free zone as a company variant (FZ-LLC / FZCO)

An LLC gives you:

a standalone legal entity

ability to sign bigger contracts

growth capacity (staff, offices, multi-activities)

Dubai mainland LLCs operate under the Dubai Department of Economy and Tourism licensing environment.

Dubai Freelance Permit vs LLC: Quick Comparison Table (2026)

(Highly Featured Snippet friendly)

Factor | Freelance Permit | LLC Company |

|---|---|---|

Best for | Solo freelancer | Business scaling |

Legal entity | Individual | Company |

Liability protection | Limited | Strong (limited liability) |

Visa | Yes (usually 1) | Yes (1+ depending on office) |

Hiring staff | Not designed for it | ✅ Allowed |

UAE corporate clients | Sometimes harder | ✅ Easier |

Setup cost | Low | Medium–High |

Banking | Possible but strict | Easier with structure |

This table is the simplest way to understand the Dubai Freelance Permit vs LLC in 2026.

Cost Breakdown: Freelance Permit vs LLC (2026 Reality)

Let’s talk actual cost buckets—because this is what founders care about.

Dubai Freelance Permit Cost 2026 (Typical Components)

You’ll usually pay for:

Freelance permit issuance

establishment card

visa + medical + Emirates ID

insurance (in many cases)

renewal yearly

A freelance permit is often marketed as “cheap,” but hidden costs usually come from visas and renewals—not the permit itself.

Wings9 insider tip:

Many applicants underestimate visa-linked costs by 20–30%. We always provide the full visa-inclusive cost model upfront.

Dubai LLC Company Formation Cost (Typical Components)

LLC costs vary based on:

mainland vs free zone

activities

office requirement

visa quota

Typical cost heads:

trade licence

MOA drafting/notarisation (mainland)

office lease or flexi desk

visa(s)

compliance setup (accounting, corporate tax readiness)

For decision-stage users, the real insight is this:

A freelance permit is cheaper to start.

An LLC is cheaper to scale.

This is the hidden truth behind the Dubai Freelance Permit vs LLC.

Legal Difference That Matters Most: Who Can You Contract With?

Freelance Permit: You Contract as an Individual

You invoice under your name/permit identity. That’s fine for:

international clients

small UAE clients

project contracts

But many corporates prefer vendor onboarding that requires:

company trade licence

corporate bank account under the company name

VAT/tax readiness (where applicable)

LLC: Your Contract as a Company

An LLC is built for:

corporate agreements

vendor registrations

long-term retainers

multi-service packaging

If your goal is credibility + bigger contracts, the Dubai Freelance Permit vs LLC becomes an easy choice.

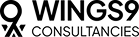

Visa & Residency: Freelance Visa Dubai vs LLC Visa

Freelance Visa Dubai

Typically:

1 residence visa linked to your permit

Some options allow dependent sponsorship (case-based)

renewals tied to permit status

LLC Visa

LLC gives flexibility:

investor/partner visa

employee visas

dependent sponsorship is easier as the structure scales

Also, visa allocation in LLC models can expand based on office size and licensing capacity.

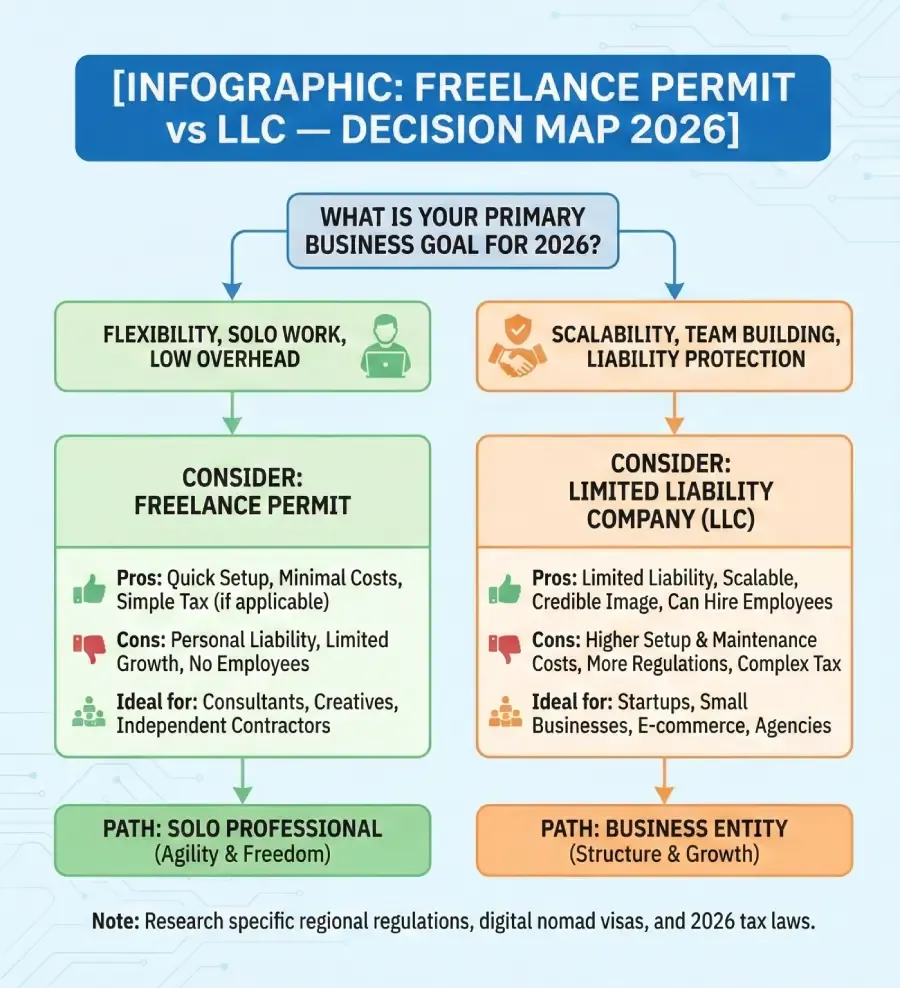

Banking Reality in 2026 (Don’t Ignore This)

Here’s what we see every week at Wings9:

Many people get a licence fast… and then get stuck for months at bank account stage.

Freelance Permit Banking

Possible, but banks can request:

strong client contracts

invoices and portfolio

proof of residence

income evidence

LLC Banking

Generally smoother because:

Company structure is standard

activity matches licensing

MOA supports clarity

Compliance posture looks “stronger”

If you’re a consultant or coach planning to bill UAE clients, the Dubai Freelance Permit vs LLC should be evaluated with a banking-first lens—not setup cost.

Tax & Compliance (2026): What You Must Plan For

UAE corporate tax is now part of business maturity.

Freelancers

Freelancers may fall under:

individual income considerations

self-employed compliance behaviour

Potential requirements if operating as a business

LLCs

LLCs need:

accounting

corporate tax registration/filing

audit (some free zones require)

The Federal Tax Authority remains the key authority for corporate tax frameworks.

Wings9 insight:

The compliance cost is real, but it’s also what unlocks corporate credibility. Serious money usually follows serious structure.

Mainland LLC vs Freelance Permit UAE: When Mainland Wins

Mainland LLC is ideal when:

Your customers are in the UAE

You need unlimited UAE market access

You want to open an office/shop

You want contracts with the government/semi-government

You want long-term scale

Dubai mainland licensing is managed under DET.

When Freelance Permit Is the Smarter Choice (2026)

We recommend a freelance permit if:

You’re testing the UAE market

You’re a solo consultant with foreign clients

You don’t need staff

You don’t want office overhead

You want a lean setup that allows residency

It’s the best first step for many expats relocating in 2026.

When LLC Is Non-Negotiable

An LLC is the right choice if:

You want to hire staff

You want multiple activities

You want strong liability protection

You want to scale beyond “solo income”

You want a brand that can be sold/valued later

Pro Tip (Wings9 Shortcut):

Many founders start with a freelance permit, thinking they’ll upgrade later. But “upgrade” often means redoing everything—licence, bank account, contracts, sometimes even branding. We help clients model this before they choose.

Step-by-Step Setup Timeline (Freelance vs LLC)

Freelance Permit Setup Timeline

Choose activity category

Register with the Free Zone authority

Permit issuance

Establishment card

Visa processing

Bank account attempt

LLC Setup Timeline (Mainland)

Activity + trade name reservation

Initial approval

MOA drafting & notarisation

Office Ejari

Licence issuance

Immigration file setup

Visa(s)

Corporate bank account

This is why the Dubai Freelance Permit vs LLC is also a timeline decision.

FAQ

1) Is a Dubai freelance permit cheaper than an LLC?

Yes, for most solopreneurs. Freelance permits have lower startup and overhead costs compared to LLC structures.

2) Can I hire employees on a freelance permit?

Generally no. Freelance permits are designed for individuals. To hire staff, an LLC is more suitable.

3) Can I work with UAE clients using a freelance permit?

Yes, but larger corporates may require vendor onboarding with an LLC trade licence and a corporate bank account.

4) What is better in 2026: a freelance permit or an LLC?

If you’re solo and testing markets, freelance is best. If you want long-term growth, credibility, and contracts, an LLC is better.

5) Can I convert a freelance permit into an LLC later?

You can upgrade, but it usually requires new licensing and banking processes. Plan early to avoid duplicated costs.

6) Is a mainland LLC better than a free zone freelance permit?

Mainland LLC is better for the UAE market access and scaling. Free zone freelance permits are better for lean international services.

7) Do freelancers pay corporate tax in Dubai?

Tax obligations depend on how you operate and your income structure. LLCs must follow corporate tax compliance rules as applicable.

Pillar Page Integration

This article is a high-intent sub-topic under our main guide:

👉 https://wings9.ae/company-formation-in-dubai-2026-mainland-vs-free-zone/

If you’re still deciding between mainland and free zone structures for your business, that pillar page will clarify the bigger picture.

Wings9 2026 Outlook (Unique Takeaway)

Here’s our real 2026 prediction:

Freelance permits will surge—but LLCs will dominate the high-income segment.

Why? Because in 2026, the best-paying clients in Dubai want:

corporate invoices

compliance confidence

vendor-ready documentation

So if your goal is “living in Dubai,” a freelance permit is enough.

If your goal is “building wealth in Dubai,” an LLC becomes your profit engine.

Ready to Choose the Right Setup?

We at Wings9 Management Consultants help you select the best structure, process your licence, handle visas, and prepare bank-ready documentation—fast.

Start your Dubai journey with Wings9.